‘$7.7 trillion, $29 trillion, whatever! They own us, OK?’

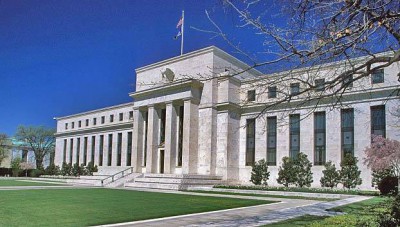

Federal Reserve chairman Ben S. Bernanke disclosed today that as of 2008, the U.S. has belonged to Goldman Sachs.

Of course, China owns $1.1 trillion of U.S. debt and Japan owns another $900 billion. But that is just a drop in the bucket compared to the “$7.7 trillion or $29 trillion, whatever — our bookkeeping is not so good” that the Fed now admits it gave the major banks and Wall Street financial firms to keep them afloat after the crash of 2008.

Previously, a figure of $700 billion was thought of as the entire bailout, but a recent Freedom of Information Act (FOIA) request revealed the true nature of the giveaway to the financial industry.

“Once we realized we’d never get it back,” Bernanke said, “we decided to just hand over the deed as well. We wanted to come completely clean on this, so you know we are not hiding anything else.”

“Goldman Sachs will act as the trustee,” he said, “and we’re confident they will be a responsible landlord and deed holder for the entire banking community. Don’t worry, America, you’re in good hands.”

Ernest W. Williams, a conservative economics professor at George Mason University in Fairfax, Virginia, explained it this way: “When you can no longer make payments on a heavily mortgaged house, the bank repossesses it, right? Well, essentially, the Fed just repossessed the U.S., which is in extreme debt.”

“Sure, the banks actually owed the government in this case, to the tune of $29 trillion or so, but the government, in turn, owed the Fed, which has been loaning it money it created out of thin air for decades,” Williams added.

The Federal Reserve, created in 1913, essentially took over the money-creation and regulation power that the Constitution (that quaint document which seems so irrelevant today) gave to the federal government. If that hadn’t happened, the government would only be in debt to itself, since it would have created its own money.

“But that archaic sense of national autonomy was discarded by the wise founders of the Fed, which is essentially a club made up of the major banks as its members,” said Williams. “They are the smart ones when it comes to finance, and they saw that it was important to relieve the government of this heavy burden.”

“And so, with a few well-placed bribes and a vote in a nearly empty Senate chamber over the Christmas holidays in 1913, the Fed was born!”

Some say the economic crash proves that the financial industry is not so smart. “Balderdash!” said Williams, “it got ’em a free $29 trillion, didn’t it?”

“And now the poor, clueless government doesn’t have to worry about a thing. They don’t even own the country anymore,” Mr. Williams concluded.

- Humor Times 34th Anniversary Issue is OUT: the Political Satire Revolution Continues! - March 6, 2025

- Book Review: ‘The Mind of a Horse’ - December 26, 2024

- Second Go-Around Bound to Be Worse than the First - December 18, 2024